The Federal Reserve is done sitting on the sidelines as inflation continues to dilute American’s purchasing power. The red-hot housing market is one of the drivers of inflation, but as the FED continues to raise rates, some good work is getting done.

There is much evidence that the FED raising rates is taking some steam out of the housing market. There has been a clear shift since rates hit 5% at the end of March/Beginning of April. Devyn Bachman, VP of research at John Burns Real Estate Consulting, gave some much needed color on the issue. “We are hearing about qualification issues, rising cancellations, and increased buyer hesitancy, particularly at entry level points and in remote locations,” Devyn stated. Inventory bottomed out in mid-March, but since then has posted 3 weeks of rising inventory. Real estate Redfin also reported an increase in the share of sellers reducing their prices on their site, an indicator that demand for second homes is decreasing.

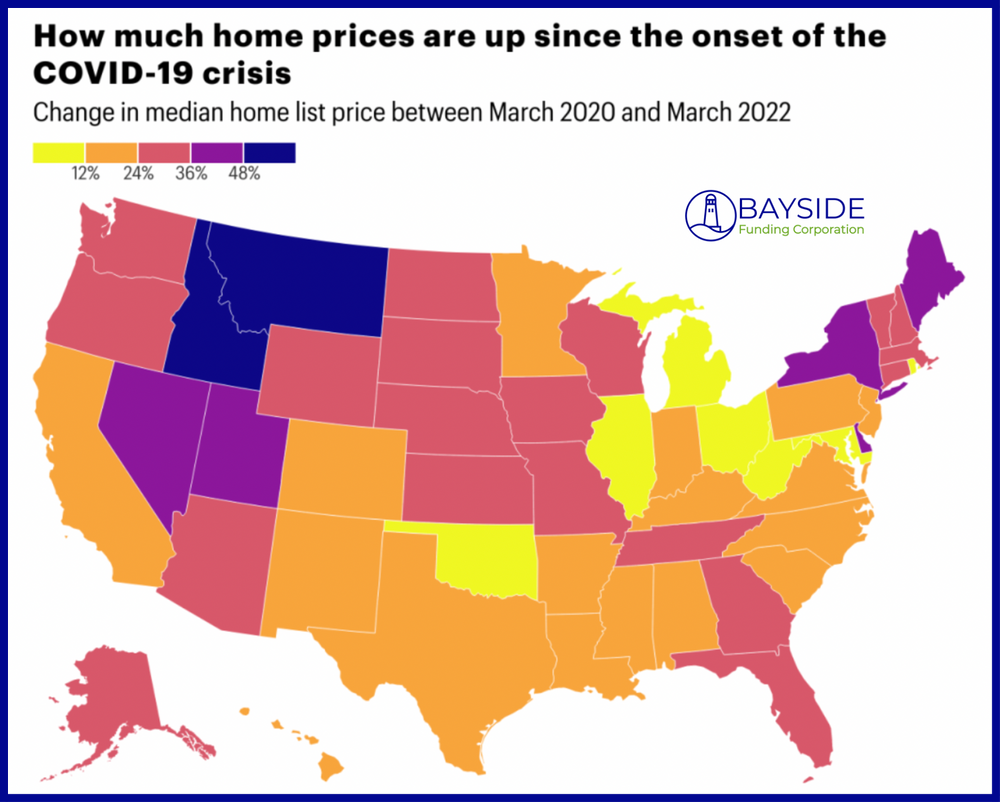

This is still a slowing rate of growth, however. We are still in the middle of the hottest real estate market in recorded history. Bidding wars are normal, inventory remains historically at rock-bottom. The reason buyers are backing out of the market is due to mortgage rates increasing at the quickest pace in 40 years. Mortgage brokers are quoting borrowers at 5% instead of 3%, adding an additional $400 or so to their monthly payment. With all of this being said, not many speculators expect home prices to drop anytime this year. "My short answer is that unlike the housing bubble and crash of the mid 2000s, the recent increase seems to be sustained by the substantive supply and demand issues I have detailed—not by excessive leverage, looser underwriting standards, or financial speculation," Fed governor Christopher Waller told a conference audience in March. "I am hopeful that at least some of the pandemic-specific factors pushing up home prices and rents could begin to ease in the next year or so."